update

lets do the big picture first. below is BTC chart since inception.

every single time BTC crossed the previous all time high (marked in grey line),

it spend some time consolidating (marked in pink circles)

before making a exponential move up (marked in green lines)

this took place even as early as 2013 when there wasn't even high volume trading happening in BTC.

same in 2017 and 2021.

we are in a similar position now.

not just from price perspective but underneath the surface many of the variables that the system tracks are pointing towards it.

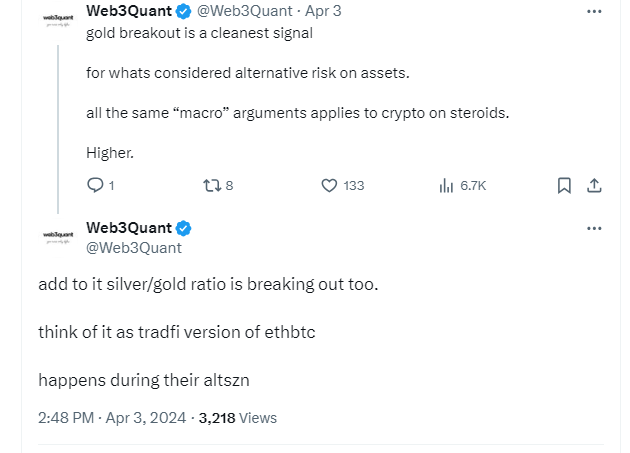

from a macro perspective one other interesting happening is GOLD is making new all time highs too.

very soon we are likely to have next explosive move upwards and BTC heading towards 100k-150K as mentioned in the bull thesis last year.

this does not mean go max lever long.

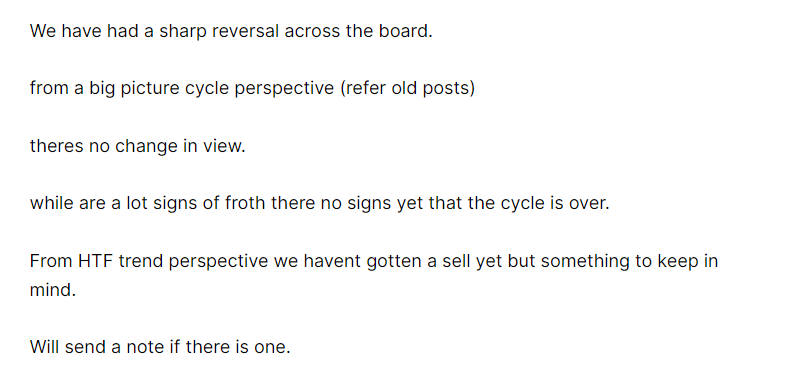

last weeks update title was long your longs but the very next day we had a mini flush.

but this time we never got a HTF sell as mentioned in the mid week update

the bottomline is even during the strong HTF bullish phase we will have periods of consolidations and nasty flushes.

idea here is to have a directional big picture thesis but be nimble to pivot should the data change abruptly or the trend break.

since the whole bull cycle began in early 2023 we have had very same pattern playing out.

sharp upmove followed by sideways (marked in pink circles)

1st and the 4th one were quicker and deeper whereas the 2nd and the 3rd ones were long shallower but stretched out time wise.

we havent gotten one yet bt if we get another red on web3quant indicator then it would indicate we would need some more time before the next uptrend kicks in.

but what if its truly different this time? its very much a possibility.

thats why we have data driven systems in place and thus far its caught all the moves.

unlike the earlier 4 year cycle pattern this time we have had shorter bear and faster ATH

which opens the door for a shorter cycle (climax in 2024) or

a double top like it did in 2013.

as always we will continue to follow the system.

other things thats playing out differently and likely to continue are

> memes have been the standout winners of this cycle

>all the explosive gains are happening onchain rather than in exchange listed coins.

thus far its been Sol ecosystem plays but all data is pointing that we will have BTC and base ecosystem plays joining the party.

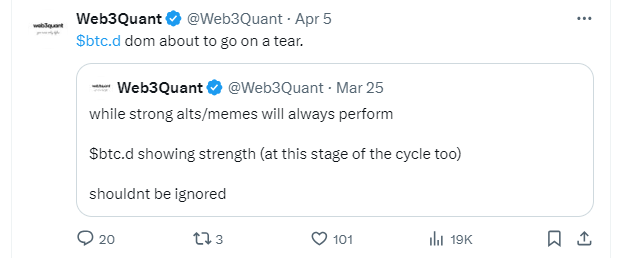

>Strong BTC dominance

so unlike the past its not been the case where btc goes up and all alts go up more.

infact unless ones been in the right sectors they have not experienced those explosive returns.

thats also perhaps why we are not seeing much noise from normie / retail as much as the previous cycles.

Coming to positions.

DOGE / DOG & WIF are looking really strong.

theres a play i like from BTC ecosystem and will be one of the cycle plays.

NOTE: wont be getting into logistics on how to or where to buy it. its deployed both on btc and solana.

similar to DOG thesis this play too has both NFT and memecoin aspects to it.

from a valuation perspective being on BTC alone gives it a LOT of room for upside.

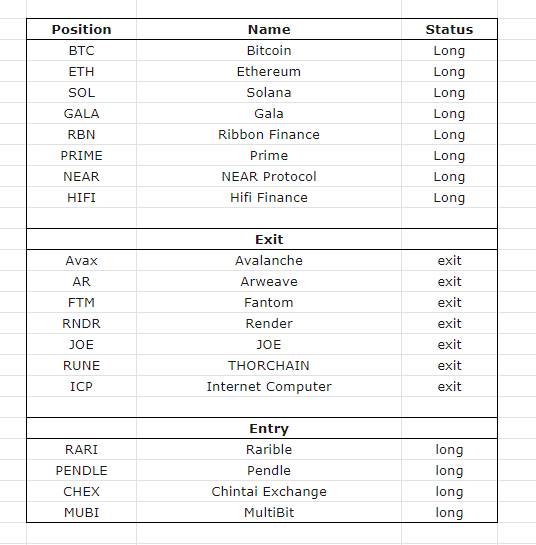

from a trend model perspective there have been new 4 entries and 7 exits.

** Web3Quant is not registered with any financial regulatory agencies. Web3Quant content is purely for research, education, and entertainment purposes and should NOT be considered personalized financial advice. Do your own research and consult your financial advisor.**